IF&CR’s Fuel Review for Northern Ireland – compiled by Green Street

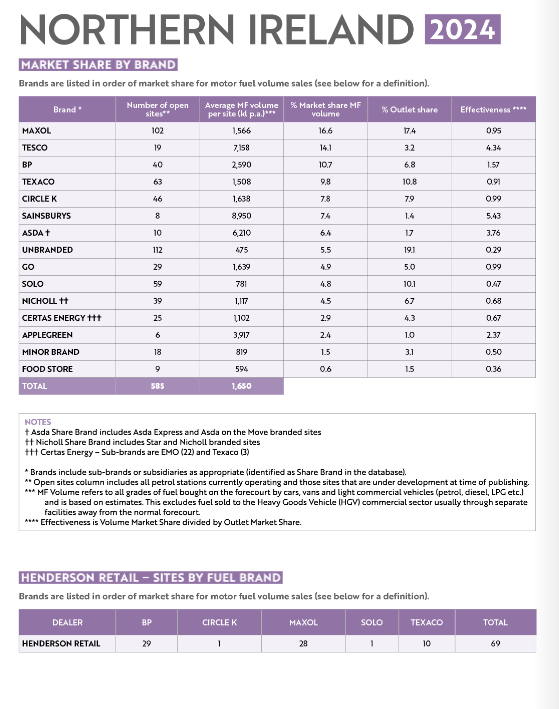

This report takes a deep dive into Green Street’s report for Northern Ireland. Looking first at Market Share by Brand – Maxol is the front runner with 102 sites. There are 112 ‘unbranded’ sites – still surprisingly high for a small regional market.

It’s interesting to note that although Applegreen has six sites in the North, it has 3,917 average MF volume per site (kl p.a.)*** while TESCO, with 19 sites has 7,158 average MF volume per site (kl p.a.). Unbranded – although with 112 sites, has only 475 average MF volume per site (kl p.a.).

Clearly Applegreen’s motorway locations makes a difference to volume.

In terms of site numbers, Texaco takes second place with with 63 and Solo follows that with 59 branded sites.

Circle K has 46 sites in the North, while Nicoll (including the Star brand) have 39.

The number of Go sites in Northern Ireland has increased to 29.

When it comes to market share by brand, Maxol tops the table with 16.6% Market share MF volume and 17.4% Outlet share.

The table below liists market development by brand – comparing the number of open and under development by sites by brand, for the current release of data and the same period in 2023. It also shows the change in site numbers for each brand during the last 12 months, to give a clearer picture of which brands are expanding and which are reducing site numbers.

When it comes to Market Share by Ownership in Northern Ireland, there are 471 dealer sites open, and 78 company sites, with 36 owned and operated by hypermarkets (Tesco, ASDA, Sainsbury).

This gives the six counties of the North of Ireland a total of 585 sites, with an average MF volume per site of 1,650.