Irish shoppers reset after festive splurge – Online grocery outperforms the market

Take-home grocery sales in Ireland rose by 5% in the four weeks to 25 January 2026, according to the latest data from Worldpanel by Numerator, with shoppers spending more than €1.2 billion on groceries over the period.

While shoppers made slightly more trips to stores compared to the corresponding period last year, they purchased 1.9% fewer packs year on year, highlighting continued caution among Irish consumers as grocery inflation rose to 6.82%, up from 6.25% over the 12 weeks.

Commenting on the latest figures, Emer Healy, Business Development Director at Worldpanel by Numerator, said: “January is typically the time when shoppers reset their household budgets, and this year was no different. While grocery sales continued to grow, rising inflation meant that value remained front of mind for consumers.

“Our latest pressure group study reveals that more shoppers in Ireland are finding the current economic climate tough, with 31% feeling that they are struggling to make ends meet. This is no surprise: rising grocery inflation means that consumers are increasingly feeling the pinch.”

After grocery spending hit a record high in December, shoppers have looked to rein in costs in January, a trend that would typically boost the share of own label products. Grocery spending and the volume sold on promotion over the latest 12-week period remained at a record low of just 19.6%, suggesting that shoppers are managing their budgets through everyday choices rather than increased promotional purchasing.

Own label products accounted for 43.4% of total grocery spend, up 0.7 percentage points on the previous month, with shoppers spending more than €1.7 billion on own label goods over the latest 12-week period. The strong performance of premium own label goods also continued, with growth standing at 5%, while branded products remained resilient, growing 7.3% and ahead of the total market, which grew at 5.2%.

Shoppers prioritise health after indulgent festive period

In January, Irish shoppers spent an additional €454k on low- and no-alcoholic beverages, amid greater participation in Dry January. Spending on fresh fruit, chilled smoothies, juices and yoghurts was also on the rise, increasing by more than €8.1 million, while healthcare sales increased 6.8% year on year, with consumers ploughing an additional €1.8 million into the category as they stocked up in time for the start of flu season.

Emer Healy added: “As shoppers refocus on health after the indulgence of the festive period and the onset of flu season, we’re seeing growing demand for everyday staples that support their wellbeing goals, such as products rich in protein and fibre. The wettest January in eight years also drove demand for ‘comfort food’ options to be enjoyed at home.

“Rather than following short-term, diet-driven trends, consumers are opting for a more balanced, sustainable approach to healthy eating built around familiar, accessible foods that fit naturally into their daily routines. With more shoppers exploring plant-based choices through Veganuary, meat alternative products experienced an uplift during the period, with shoppers spending an additional €838,000 on meat substitutes versus last year.”

Online grocery outperforms the market

Online grocery sales continued their strong march, rising 7% year on year to take 5.8% value share. Shoppers spent an additional €15 million online, driven by larger trips, with nearly 20% of Irish households purchasing groceries online during the latest 12-week period.

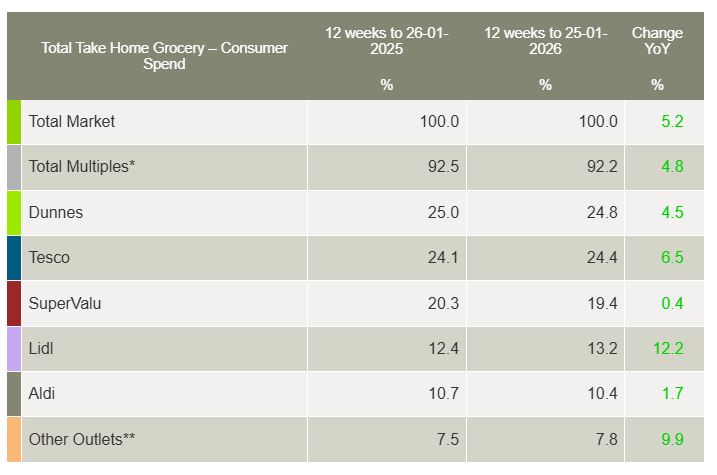

Among the retailers, Dunnes holds 24.8% market share, up on the previous 12-week period and with sales growth of 4.5% year on year. Larger trips and new shopper recruits contributed an additional €29.8 million to its overall performance.

Tesco holds just under a quarter of the market, at 24.4%, with value growth of 6.5% year on year. An influx of new shoppers contributed an additional €27.9 million to the grocer’s overall performance.

SuperValu holds 19.4% market share, with growth of 0.4%. It remains the most frequently visited grocer, averaging 22 trips per shopper, while new shopper recruits over the 12-week period contributed an additional €36.7 million to its overall performance.

Lidl was once again the fastest-growing grocer, up 12.2% and holding 13.2% of the market. Alongside recruiting new shoppers in-store, existing shoppers picked up more volume in store, with both groups combined contributing an additional €29.9 million to overall performance.

Aldi holds 10.4% market share, up 1.7%, driven by an influx of new shoppers who drove an additional €13.8 million in sales.