Take Another Look – IF&CR ‘Fuelling the Nation 2024 – Irish Fuel Review’

Here’s a chance to take another look at the IF&CR’s annual Fuel Review. IF&CR commissioned London based consultancy Green Street to curate the detailed and comprehensive report.

In this special Fuel Review focused edition of CLICK, we are providing our readers with another chance to take a deep dive into the detail of the report.

Firstly, we feature an overview here of the two reports covering both jurisdictions on the island – one for Ireland, the other for Northern Ireland.

Then, we separate the reports for both jurisdictions.

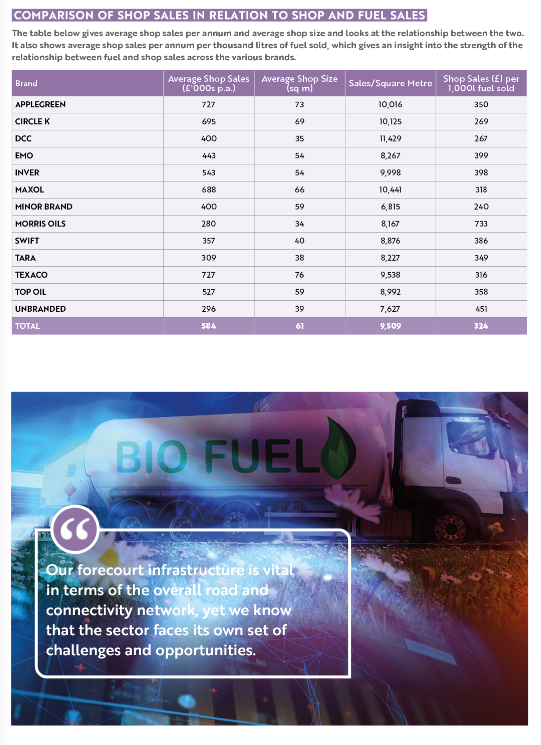

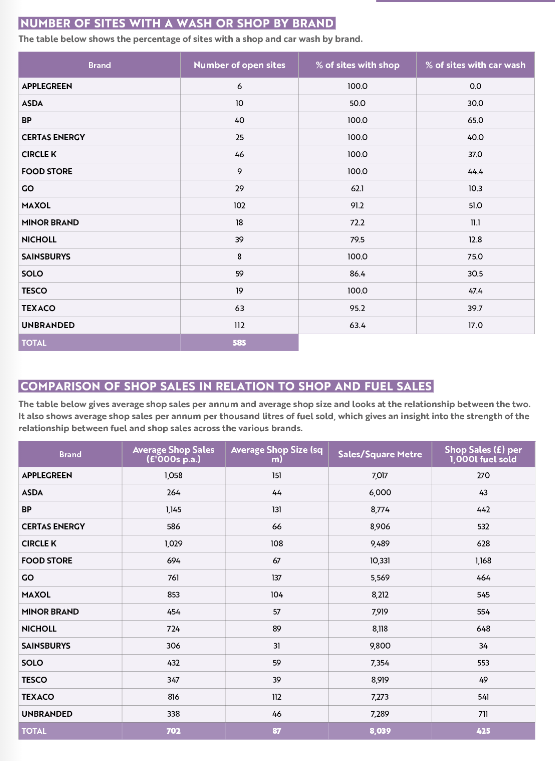

This edition of CLICK also takes a more defined look at comparisons of Shop Sales in relation to Shop and Fuel Sales.

Finally, we examine Market Share by Brand.

It is a fact that Ireland has one of the most developed and sophisticated forecourt network in the world, often viewed as a role model for other countries.

Our forecourt infrastructure is vital in terms of the overall road and connectivity network, yet we know that the sector faces its own set of challenges and opportunities.

As such, the data contained in the following reports shows a healthy, vibrant sector. In Ireland, there are a total of 1840 service stations. Interestingly, the highest figure (388) is for unbranded outlets. Circle K tops the branded list, with 356 locations, Top Oil with 248 and Applegreen with 192 branded locations (in Ireland, excluding the north).

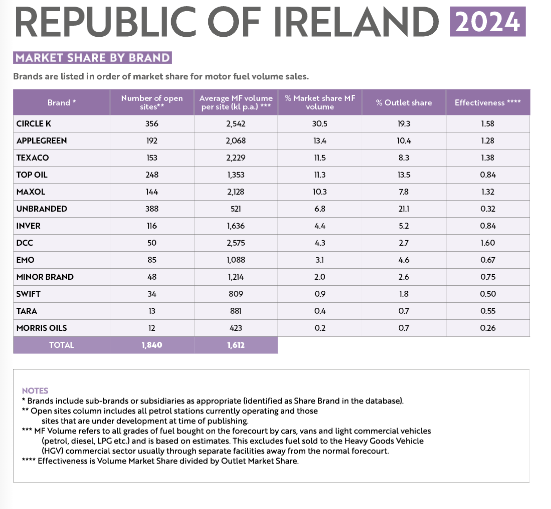

Market Share by Brand – Ireland

Circle K tops the market share by MF volume at 30.5% followed by Applegreen with 13.4% MF market share. Interesting, the 388 unbranded sites only have 6.8% market share per MF volume.

When it comes to Outlet Market Share, Circle K leads the brand names, followed by Top Oil and Applegreen – with Unbranded at 21.1% Outlet Market Share.

The average average MF volume per site (kl p.a.)*** is 1,612. DCC tops the chart with an average MF volume per site (kl p.a.)*** of 2,575, followed by Circle K (2,542), then Texaco (2,542) and Applegreen (2,068). Unbranded trails at 521 MF volume per site.

Definitions are included beneath each of the tables for clarity.

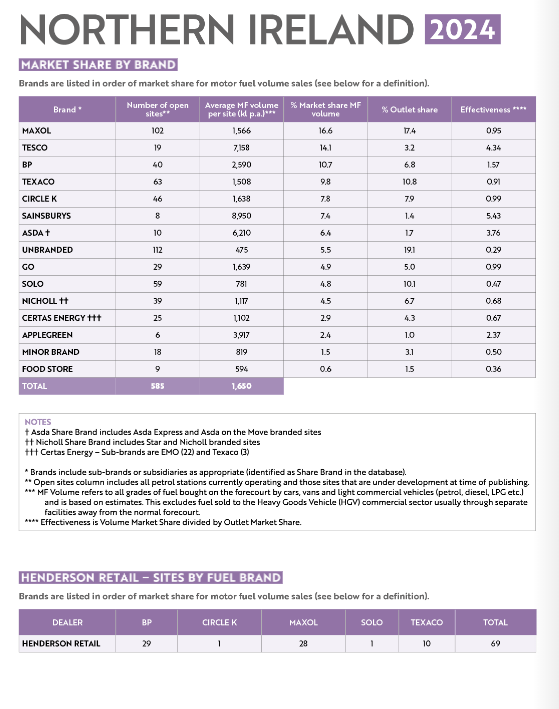

Market Share by Brand – Northern Ireland

Maxol tops the branded list in Northern Ireland with 102 sites, followed by Texaco at 63 and Solo at 59, although there are a total of 112 Unbranded sites in Northern Ireland. Maxol also leads the branded market share by MF volume at 16.6%% and an outlet share of 17.4%.

It’s interesting to note that although Applegreen has six sites in the North, it has 3,917 average MF volume per site (kl p.a.)*** while TESCO, with 19 sites has 7,158 average MF volume per site (kl p.a.). Unbranded – although with 112 sites, has only 475 average MF volume per site (kl p.a.)

When it comes to market share by brand, Maxol tops the table with 16.6% Market share MF volume and 17.4% Outlet share.

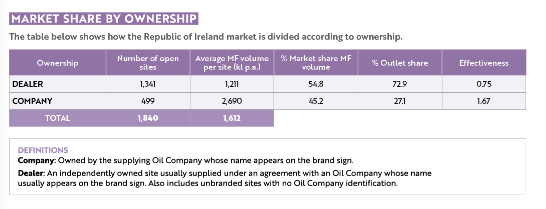

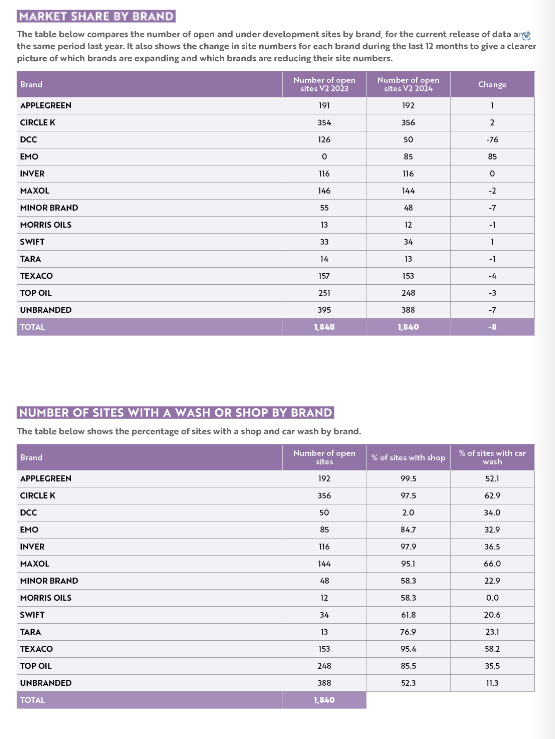

This fuel review also includes detailed data on Market Share by Brand, Market Share by Ownership, Market Development by Brand and the number of sites with a shop or car wash by brand.

Our fuel review also includes Comparisons of Shop Sales in relation to Shop and Fuel Sales.