Shoppers spent €24.6m on Easter Eggs – an additional €9.3 million on last year.

Take-home grocery sales rose 4.5% in the four weeks to 17 March 2024, with €1.1bn running through the tills. Shoppers spent an additional €47.8 million on take-home grocery versus the same time last year. In March, the average price per pack rose 4%, while volumes per trip fell by 1.2%.

Although value sales are up, grocery price inflation is the main factor behind this rather than more spending. Grocery inflation rose by 3.7% in the 12 weeks to 17 March 2024, which is down a significant 12.3 percentage points versus March 2023.

This is the eleventh month in a row that there’s been a drop in inflation, which will be very welcome news for consumers. While it’s the lowest inflation level we have seen for two years, shoppers in Ireland are still on the hunt for value with over 25% of value sales coming from promotions.

Easter puts the Spring in March sales

With Easter on the horizon and Easter eggs hitting the shelves earlier every year, it’s no surprise that Irish consumers have been stocking up on classic seasonal treats. During the month of March nearly half of all Irish households purchased Easter eggs, which is up 13.1 percentage points versus last year. Shoppers spent a mammoth €24.6 million on Easter Eggs and which was an additional €9.3 million versus last year. However, many also opted for other popular Easter treats spending €1.1 million on hot cross buns, which are up 28% year-on-year.

Retailers have also been bumping up promotional activity during Easter with over 51% of value sales of Easter eggs sold on promotion. Alongside promotions, retailers are also placing an emphasis on own label lines to get shoppers through the doors. Sales of own label performed strongly, growing ahead of the total market at 5.5% year-on-year and holding value share of 48%, with shoppers spending an additional €80.5m year-on-year.

Premium own label ranges continued to perform well with shoppers spending an additional €172m on these lines, 12.3% increases compared to this time last year. Brands also saw growth over the 12 weeks of 3.8%, slightly behind the total market.

Online sales were up 16.7% year-on-year with shoppers spending an additional €26.5 million online year-on-year. New shoppers, alongside larger trips, boosted online’s overall performance by €16.3 million.

Irish retailer performance update

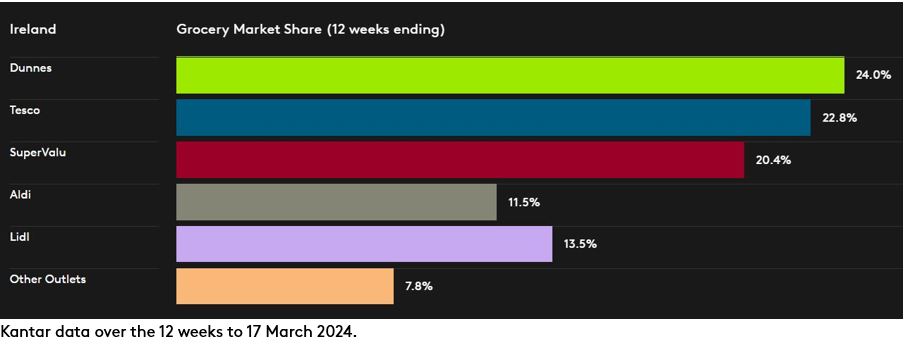

Dunnes holds 24% market share with growth of 7.7% year-on-year. This growth stems from more frequent trips, up 5.4%, which contributed an additional €38.2 million to overall performance.

Tesco holds 22.8% of the market, up 7.5% year-on-year. Tesco has the strongest frequency growth amongst all the retailers for another month in a row, which contributed an additional €50.8 million to the overall performance.

SuperValu holds 20.4% of the market with growth of 3.1%. SuperValu shoppers make the most trips in-store when compared to all retailers, 21.3 trips on average and a boost in volume per trip, which contributed an additional €12.4m to the overall performance.

Lidl holds 13.5% share with growth of 5.4% year-on-year. More frequent trips contributed an additional €30.9 million to its overall performance. Aldi holds 11.5% market share with more frequent trips contributing an additional €6.4 million to the overall performance.