Figures from Kantar show a record-breaking €1.4bn passed through Ireland’s grocery tills in December, driven by soaring inflation over the last year and retailers upping promotional activity to get cash-strapped consumers spending.

The average household in the country spent an all-time high of €767 on groceries across the month, an increase of nearly €42 on 2022, and an even larger increase of €170 compared to pre-pandemic spending in 2019.

Take-home grocery value sales grew by 7.8%, while the number of packs bought declined by 5.3%. Irish shoppers made nearly 42 million trips over the four weeks to 24 December – 3.4 million more than last year and the largest number ever recorded at Christmas.

While value sales were up significantly, grocery price inflation remained the driving factor. It came in at 7.1% over the 12 weeks to 24 December– a fall of more than half from the 15.5% rate in January 2023.

Emer Healy, Business Development Director at Kantar, commented: “This is the eighth month in a row that there has been a drop in inflation, which will be welcome news for consumers. It is the lowest inflation level we have seen since August 2022, and we expect to see this gradual decline continue throughout 2024.”

Kantar noted that although the level of grocery inflation is falling, it is still exceptionally high and Irish consumers face serious pressures on their household budgets. Healy said: “Retailers worked hard during the festive season to attract shoppers by offering the best value, and promotions were central to their strategy. Nearly 29% of all spend in the 12 weeks to 24 December was made on items with some promotional offer, the highest level since January 2023 and €117m more than the previous year. Dunnes, Tesco and online all saw strong growth in sales on promotion – ahead of the total market of 12.7%.”

Alongside promotions, retailers also placed emphasis on own-label lines, which had been attracting Irish shoppers throughout 2023. Unsurprisingly, own-label remained popular over December, growing ahead of the total market at 10.4% year-on-year, and holding a 44.6% value share – up 1.2 percentage points versus last year. In total, shoppers spent an additional €151m year-on-year on own-label lines. Premium own-label ranges also continued to perform strongly, with Irish shoppers looking to indulge over the festive season. They spent an additional €177m on these lines year-on-year – a growth of 11.8%.

However, Irish consumers also reached for more branded goods to treat themselves over the Christmas period, spending an additional €105m compared to Christmas 2022 – an increase of 6.1%. This resulted in brands attaining their highest value share since January 2023, at 50.7%. Irish shoppers spent an additional combined €34.9m on branded take-home confectionary and take-home soft drinks versus the previous year.

Online sales remained strong over the 12 weeks, up 22.6% year-on-year, with shoppers spending an additional €36.6m and making more frequent trips (+9.8%). The online channel also grew its shopper base by 1 percentage points, which helped to drive overall growth.

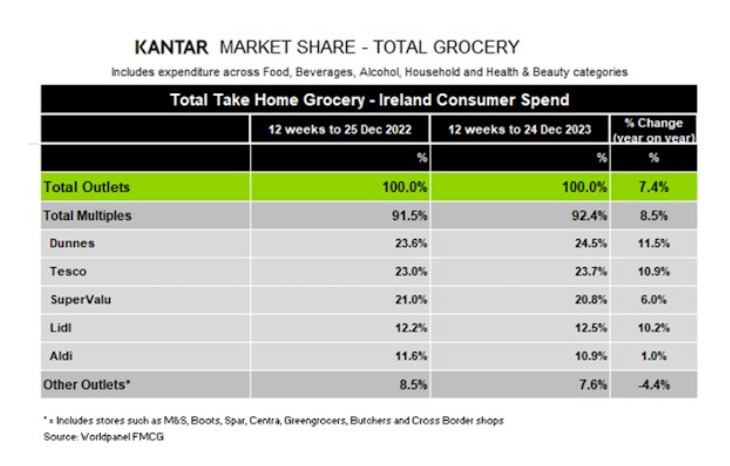

Dunnes, SuperValu and Tesco accounted for a combined market share of 69% during the quarter. Healy commented: “Traditional retailers always tend to perform well in the run-up to Christmas and 2023 was no exception. Sales were strong across their premium own-label lines, with spend on all ranges growing ahead of the total market.”

Dunnes, Tesco and Lidl all grew ahead of the total market in terms of value in December 2023.

Dunnes hit a new record share of 24.5%, with growth of 11.5%. This stemmed from a one percentage point increase in new shoppers, the highest penetration boost among all the retailers. Alongside more frequent trips and greater volume per trip, this contributed an additional €41.2m to its overall performance.

Tesco held 23.7% of the total market, which is a new record for the retailer and represents value growth of 10.9% year-on-year. Once again, Tesco also saw the strongest frequency growth among all retailers, with a 12.4% increase in trips. Combined with recruiting new shoppers in store, this contributed an additional €97.1m to its overall performance.

SuperValu controlled 20.8% of the market after recording growth of 6%. SuperValu’s shoppers made the most trips overall when compared with all retailers – an average of 22.1 – which contributed to an additional €39.6m to their overall performance.

Lidl held a 12.5% share of spending, with value growth of 10.2%. New shoppers in store, together with more frequent trips, contributed to an additional €35.9m.

Meanwhile, Aldi continued to underperform, with its market share falling to 10.9% after growing its value by just 1%. More frequent trips contributed an additional €12.7m to the discounter’s overall performance.