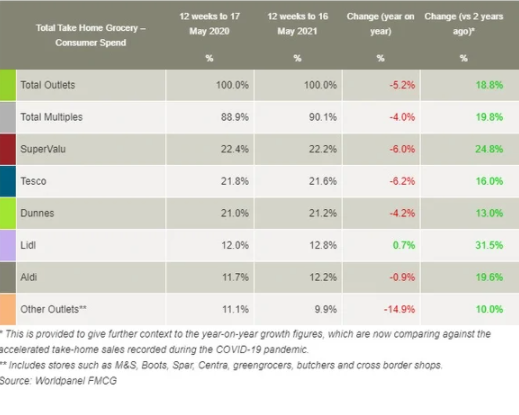

Irish grocery market droops by 5.2% – but up 18.8% since 2019

The Irish grocery market declined by 5.2% on an annual basis in the 12 weeks ending May 16, according to the latest figures from Kantar – but comparing the sector with this time two years ago – the Irish grocery sector has actually made a massive increase of 18.8%

Kantar noted that in the most recent four weeks, sales fell by 6.9% compared with the same time last year which saw record-breaking growth at the height of the first Covid-19 lockdown.

However, comparing the past 12 weeks to the same time two years ago, sales are actually up 18.8%.

An unseasonably wet and cold May impacted shopper behaviour and changed what people were putting in their baskets during the latest 12 week period.

Shoppers spent €330,000 less on chilled burgers and grills and €979,000 less on ice cream than last year, Kantar said.

People also spent €59m less on alcohol in supermarkets – the first year-on-year fall since the extraordinarily high alcohol sales during the lockdowns in 2020. As pubs and hospitality start to reopen, Kantar expects retail off-sales will fluctuate.

Consumer confidence

Emer Healy, retail analyst at Kantar, said there are positive signs that consumer confidence is improving.

“Consumers made an additional 2.1 million trips to the supermarket in the latest four weeks when compared with last year. Retired people in particular are leading the charge. They visited the grocers an extra 380,000 times this month,” said Emer.

Since the early days of the Covid pandemic, shoppers have stayed closer to home for their supermarket trips and made a greater effort to support Irish brands.

Irish brands

“We can see a real desire among shoppers to buy local. Irish brands have gone from strength to strength, and our data shows that Irish-made products and brands are generally growing faster than their imported counterparts,” Ms Healy said.

“SuperValu and Aldi have both announced that they will be increasing the number of Irish products in store, and the likes of Tayto, Brennans, Avonmore, Denny and also Cadbury, which is manufactured in Dublin, and have performed especially well in the past year,” she added.

Kantar’s figures show that SuperValu continues to hold the largest share of the grocery market at 22.2%. Kantar said its growth was mainly driven by shoppers returning to store more often, contributing an additional €41m.

Tesco remained in the second highest position with a share of 21.6%, while Dunnes accounted for 21.2% of grocery sales in this period.

Tesco and Dunnes benefited from growing confidence among shoppers and attracted new customers into stores in the past 12 weeks, with shopper numbers up 25,100 and 28,200 respectively.

Aldi also brought more customers through the doors, boosting sales by €9m and helping it to retain a 12.2% share.

Lidl was the only retailer to grow in the past 12 weeks, increasing sales by 0.7% to account for 12.8% of the grocery market. This was largely due to shoppers spending an extra €9.1m on branded items in store.